The market share of the leading used car platforms, Enka (purchase platform) and Heydealer (disposal platform), has shown a decline. While Enka remains the top choice for 3 out of 5 consumers who purchased vehicles from platforms, and Heydealer holds the top spot for 1 out of 3 consumers who disposed of their cars, both fell short of last year’s market share. Throughout the purchasing and disposal processes, K Car maintained the highest satisfaction rates.

In the 23rd Annual Automotive Planning Survey conducted by Consumer Insight, which started in 2001 and involves 100,000 participants each July, consumers who used platforms to buy or sell used cars (1,130 for purchase, 1,714 for disposal) were asked about their experiences and satisfaction levels, allowing for brand comparisons.

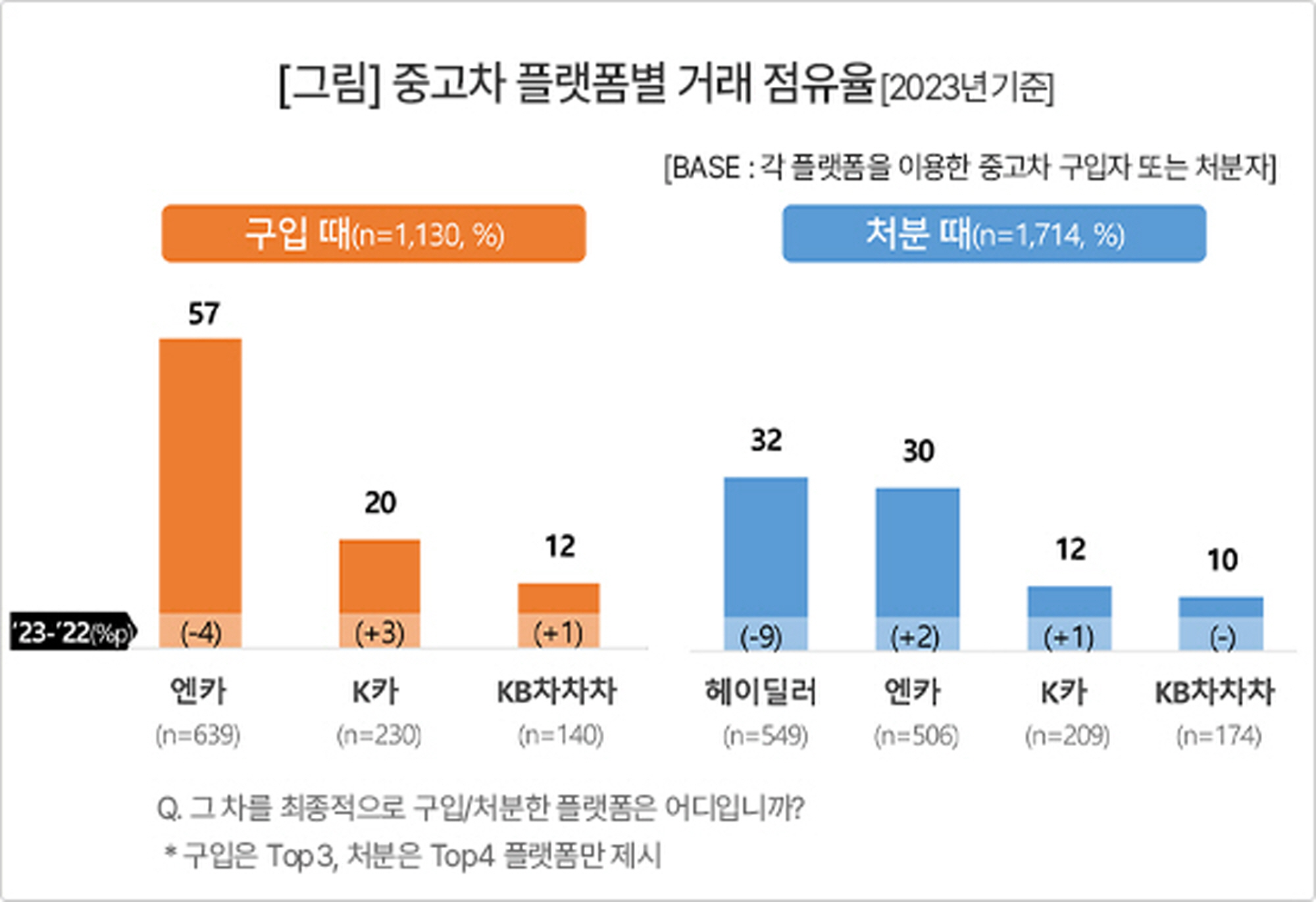

Enka led the way with 57% of consumers ultimately purchasing their vehicles from it, followed by K Car (20%) and KB Chachacha (12%). Despite a 4% point drop from last year’s share, Enka still held its first place with a clear margin over the second place. In contrast, K Car and KB Chachacha saw increases of 3% points and 1% point respectively.

However, Heydealer’s growth in the disposal market has sharply declined. With a 32% market share, it maintained its top position for two consecutive years, but this represents a 9% point decrease from last year. Enka, with a 30% share, increased its share by 2% points, closely trailing Heydealer, while K Car (12%) and KB Chachacha (10%) followed.

Heydealer’s aggressive marketing and focus on the disposal market led to a significant rise from 12% in 2021 to 41% last year, but this year it has considerably regressed to 32% (-9% points). Both brand awareness and user experience rates also dropped by over 10% points compared to last year. The leading platform, Enka, poses a renewed challenge for Heydealer.

Examining user satisfaction and dissatisfaction reveals insights into the strengths and weaknesses of these platforms. The decline in Heydealer’s market share can be attributed to ‘brand trust’ and ‘post-auction price negotiations.’ Only 10% of customers who sold cars via Heydealer cited ‘trust in the brand’ as a reason for their satisfaction, which is half the overall average (20%), while dissatisfaction due to ‘extensive price negotiations post-auction’ was more than double the average (21%).

The service ‘Heydealer Zero,’ which eliminates price negotiations post-auction, was launched in December 2021, but consumers have yet to experience its intended effects. Enka’s customers expressed high satisfaction for reasons such as ‘a large inventory’ and ‘easy platform usage,’ yet a significant portion also expressed dissatisfaction due to ‘numerous misleading listings’ and ‘unreliable market prices.’

Satisfaction rates among users (% on a 10-point scale, 8-10 points) showed that K Car maintained the highest ratings for both purchasing (58%) and disposal (51%) for three consecutive years. As a platform focused primarily on direct sales, it received high praise for having ‘fewer misleading listings’ and facilitating ‘easy transactions,’ yielding a strong brand trust. Amidst declines in market share for leading platforms, K Car’s share is on the rise.

In 2024, significant changes are anticipated in the used car market. In October and November, Hyundai and Kia launched their certified used car services, marking the official start of their operations. The expectations consumers have for existing platforms vs. those operated by manufacturers will differ, as will the services they can provide. This shift is expected to broaden consumer choices and enhance satisfaction levels.

Lee Sang-jin daedusj@autodiary.kr