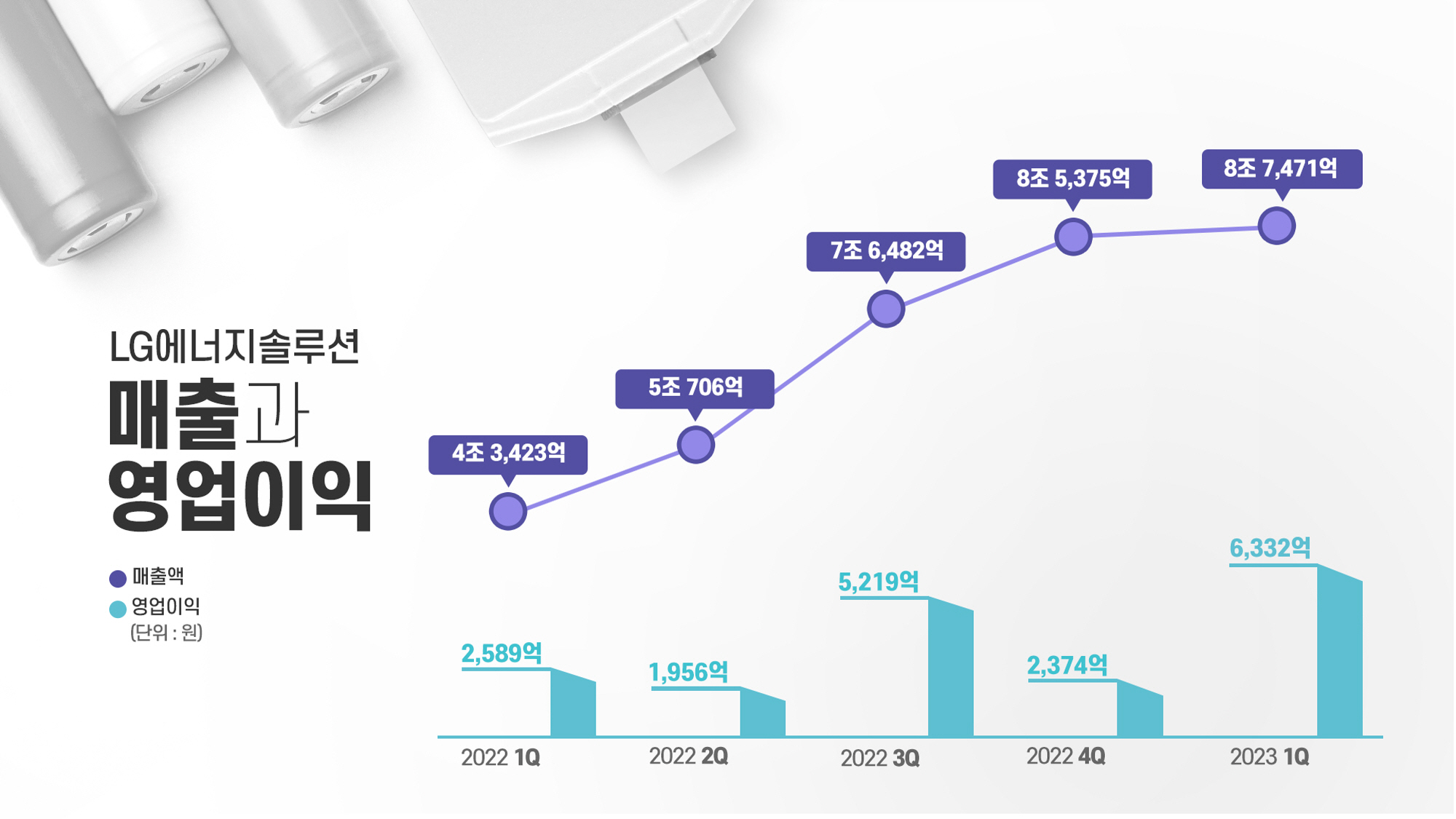

LG Energy Solution has continued its streak of sales growth for five consecutive quarters since going public.

On the 26th, LG Energy Solution held an earnings briefing announcing that it achieved Q1 2023 sales of 8.7471 trillion won and an operating profit of 633.2 billion won, marking respective increases of 101.4% in sales and 144.6% in operating profit compared to the same period last year.

The company’s Q1 2023 sales represent the highest quarterly performance to date. Since its listing on the stock exchange in January of last year, LG Energy Solution has shown five consecutive quarters of sales growth. Operating profit also rose significantly, reflecting a 144.6% increase year-over-year and a 166.7% increase compared to the previous quarter, with an operating profit margin of 7.2%.

LG Energy Solution’s CFO (Chief Financial Officer) Lee Chang-sil attributed the positive Q1 results to “performance based on differentiated competitiveness built through continuous quality and productivity improvements and supply chain strengthening activities.”

He stated, “Strong demand for electric vehicles in North America and stable operations at GM Plant 1 have contributed to the increase in EV battery shipments, leading to sales growth over the past five quarters and solid operating profits.”

Additionally, starting this quarter, LG Energy Solution has decided to include the estimated amounts from the U.S. Inflation Reduction Act (IRA) tax credits in its profit and loss statements, reflecting 100.3 billion won in operating profit. Excluding the IRA tax credit effects, the Q1 operating profit amounts to 532.9 billion won.

LG Energy Solution has emphasized its proactive investment in the U.S. market, securing production capacity and building an advanced supply chain, which have greatly contributed to enhancing its customers’ competitiveness.

As a result of these efforts, LG Energy Solution anticipates that electric vehicles equipped with batteries produced and sold in the U.S. will qualify for all IRA EV subsidies this year.

According to the IRA, EV buyers will receive $7,500 in subsidies if they meet conditions, including producing and assembling more than 50% of battery components in North America and extracting or processing more than 40% of critical minerals in North America or countries that have Free Trade Agreements (including Japan).

LG Energy Solution stated, “We will continue to focus on local production of battery components and critical minerals, as well as stabilizing supply chains outside of concern countries to actively respond to the demands of customers and consumers expecting IRA benefits.”

In practice, LG Energy Solution plans to continuously strengthen its North American production capacity for battery components, including cells, modules, and electrodes, and to promote localization of separators and electrolytes in collaboration with partners. They also plan to expand sourcing from regions outside of concern countries through equity investments and long-term supply contracts for critical minerals.

For its major business strategy in the North American market, LG Energy Solution has identified enhancing local cylindrical cell response capabilities, expanding new growth engines, and stabilizing production as key focus areas.

By securing cylindrical production bases in the U.S. and ramping up mass production of LFP-based ESS products, they aim to enhance negotiation power and market competitiveness. A key project in this respect is the construction of a new cylindrical and ESS LFP manufacturing plant in Arizona, which will be the largest independent battery production facility in North America, with a capacity of 43 GWh. Additional plans include improving yield and introducing smart factories to enhance productivity.

On this day, LG Energy Solution expressed its hope that increased subsidies for electric vehicles and eco-friendly energy will accelerate growth in the North American EV and ESS markets and that the demand for battery supply from major customers will continue to rise steadily.

LG Energy Solution CEO Kwon Young-soo remarked, “LG Energy Solution is establishing itself as a leading battery company in North America through proactive investments and expanded production capacity, and we will continue to spare no effort to become a trusted, beloved, and profitable No.1 company by providing world-class quality, cost, and delivery (QCD) to our customers.”

Meanwhile, LG Energy Solution, which is currently producing battery cells at its MI (Michigan) and GM Plant 1, expects to receive approximately 15-20 GWh in IRA tax credit benefits over the course of this year.

The company plans to expand its production capacity in the U.S. to a total of 250 GWh by factoring in GM Plants 1, 2, and 3 (140 GWh),Honda JV (40 GWh), MI standalone plant (26 GWh), and an Arizona standalone plant (43 GWh).

Lee Sang-jin daedusj@autodiary.kr