Encar.com has reported that in the midst of a continued economic downturn, the demand for small commercial vehicles, often used for livelihood purposes, is on the rise in the used car market.

Due to the prolonged economic downturn, new car sales of Hyundai Porter and Kia Bongo significantly increased last year, while the demand for 1-ton small commercial vehicles continues in the used market. Small commercial vehicles are known to be ‘livelihood cars’ that are directly influenced by economic conditions, with sales reportedly increasing during a downturn. There is high interest in used light commercial vehicles as they can be purchased at faster and more reasonable prices than new cars, particularly by consumers such as self-employed individuals and transport operators who want to buy vehicles for their livelihoods immediately.

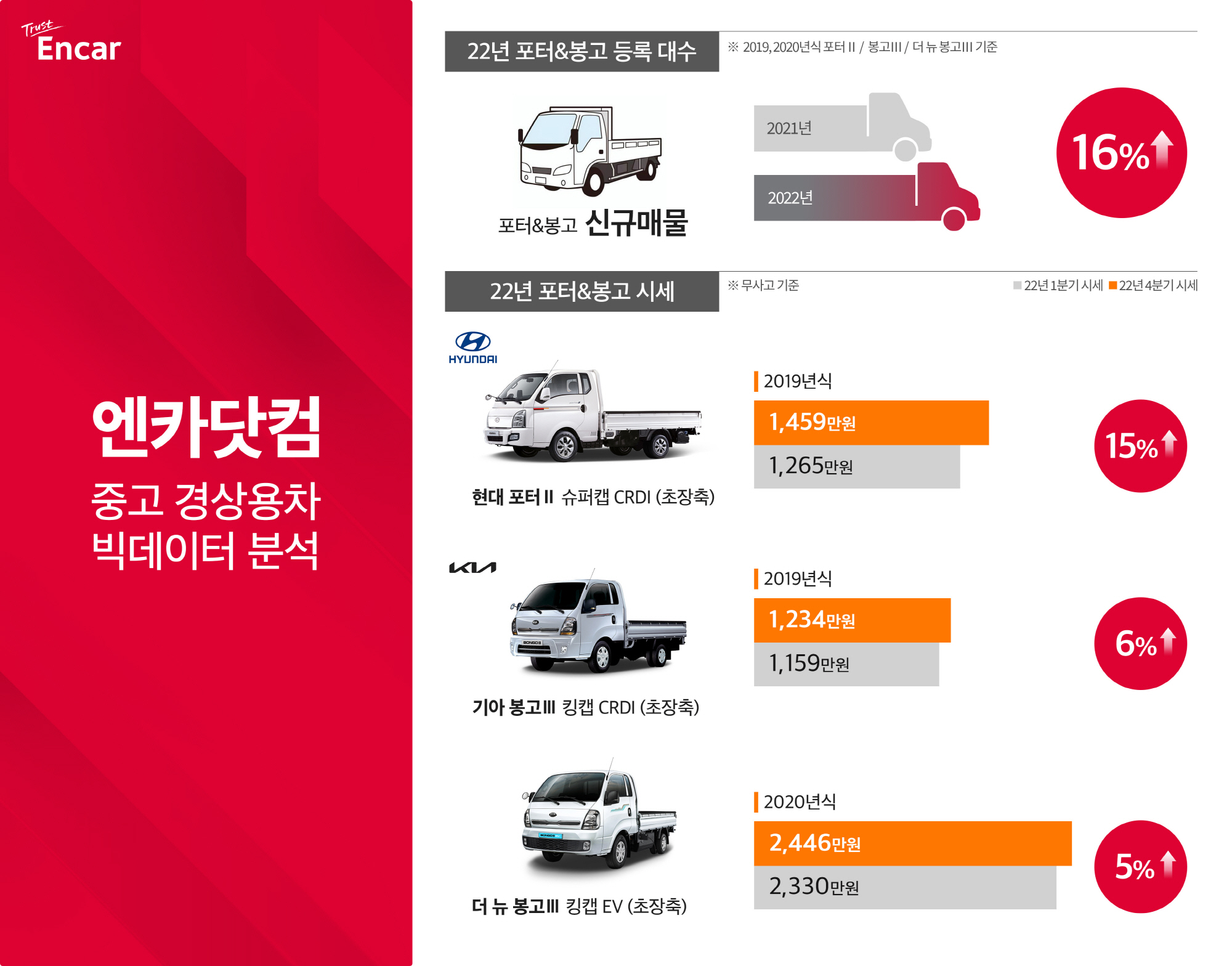

According to an analysis of the registered vehicle data on Encar’s platform, it was found that the new registrations of used Hyundai Porter II, Kia Bongo III, and the New Bongo III increased by 16% from 2021 to 2022. Last year, the number of registered Porter II vehicles rose by 14% compared to the previous year, while Bongo III registrations increased by 6%, with the New Bongo III seeing a significant rise of 135% year-on-year.

The quarterly market prices for 2019 and 2020 models of Porter II, Bongo III, and New Bongo III showed notable price increases starting from the third quarter of last year, when economic uncertainties intensified. The price increases were particularly pronounced for certain long-wheelbase Porter Super Cab and Bongo King Cab models that offer substantial cargo space and practicality.

The market price for the 2019 Hyundai Porter II Super Cab CRDI (long-wheelbase) rose from 12.65 million KRW in Q1 to 14.59 million KRW in Q4, marking a 15% increase. In the case of the more recent 2020 model, prices increased from 13.88 million KRW in Q1 to 16.96 million KRW in Q4, reflecting a significant increase of 22%. The price growth was notably larger between the second and third quarters, with the 2019 model climbing by 13% and the 2020 model by 20%.

The 2019 Kia Bongo III King Cab CRDI (long-wheelbase) also saw a rise in price from 11.59 million KRW in Q1 to 12.34 million KRW in Q4, an increase of about 6%. Due to rising fuel costs, the New Bongo III King Cab EV (long-wheelbase), which is gaining popularity in the new 1-ton electric truck market for its relatively low vehicle maintenance costs, observed a price increase of 5% in Q4 compared to Q1, with a price of 24.46 million KRW.

An Encar.com representative stated, “The increase in demand for small commercial vehicles appears to be due to a combination of factors, including the impact of the economic downturn and the expansion of the non-contact logistics transport market.” They added, “Especially in the used car market, the ability to purchase reasonably priced vehicles without waiting for new cars is highly preferred by consumers, so the market for used small commercial vehicles is expected to continue growing for the time being.”

Lee Sang-jin daedusj@autodiary.kr