Hyundai Motor Company is actively inheriting its brand heritage while accelerating its successful transition to electrification. To this end, it has prepared a medium- to long-term electrification strategy, ‘Hyundai Motor Way’, and is proactively implementing it to promote the sale of 2 million electric vehicles (EVs) by 2030.

Over the next 10 years, Hyundai plans to invest an average of 11 trillion won annually to actively pursue its electrification transition while further working to secure leadership in the future mobility industry by pushing forward with hydrogen, autonomous driving, SDV (Software Defined Vehicle), robotics, and AAM (Advanced Air Mobility) projects.

On the 20th (Tuesday), Hyundai held its ‘2023 CEO Investor Day’ at the Conrad Hotel in Yeouido, Seoul, where it announced new medium- to long-term business strategies and financial plans to investors, analysts, and credit rating agency representatives.

This event, which was enhanced by live streaming on YouTube (link), featured presentations from CEO Jang Jae-hoon, Vice President Seo Gang-hyun, who heads the Planning and Finance Division, Vice President Kim Heung-soo of the Global Strategy Office (GSO), and Executive Director Kim Chang-hwan, head of the Battery Development Center, who elaborated on the long-term strategies.

At the event, Hyundai declared its commitment to utilize the extensive know-how and unique strengths accumulated over many years of vehicle production and sales to swiftly and flexibly accelerate its electrification transition in response to intensifying competition between traditional automakers and new EV startups for future EV leadership.

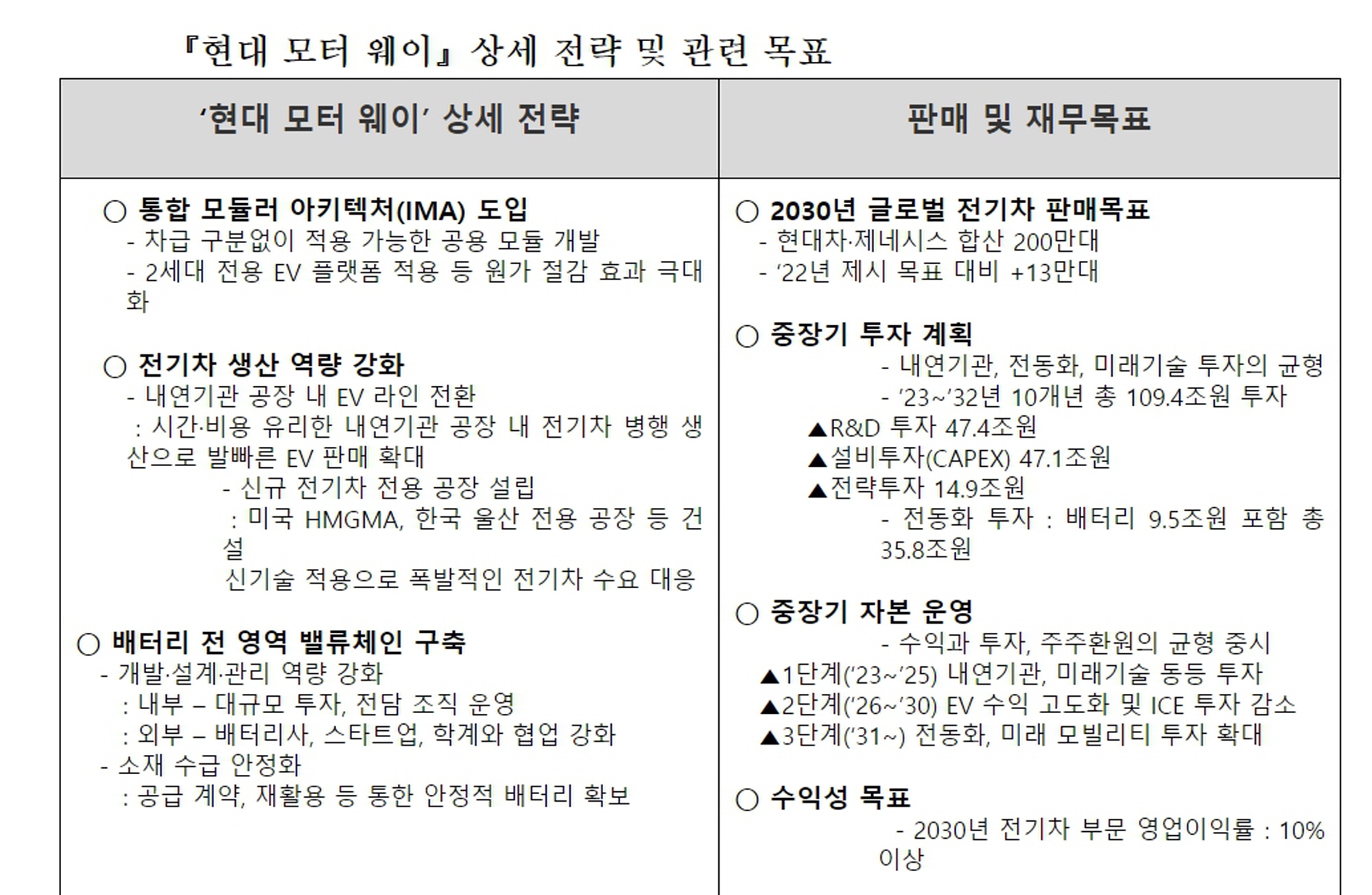

In its medium- to long-term financial plan, Hyundai aims to invest a total of 109.4 trillion won from 2023 to 2032, with 33% of that amount, or 35.8 trillion won, earmarked for electrification-related investments to actively support the execution of the Hyundai Motor Way.

CEO Jang Jae-hoon stated, “Hyundai has proactively responded to electrification and future technologies more than any other global company, and we will secure top-tier leadership in electrification in the future.” He added, “The ‘Hyundai Motor Way’ is the embodiment of the innovative DNA that many Hyundai employees have accumulated, and it will be a source of new and sustainable profit creation.”

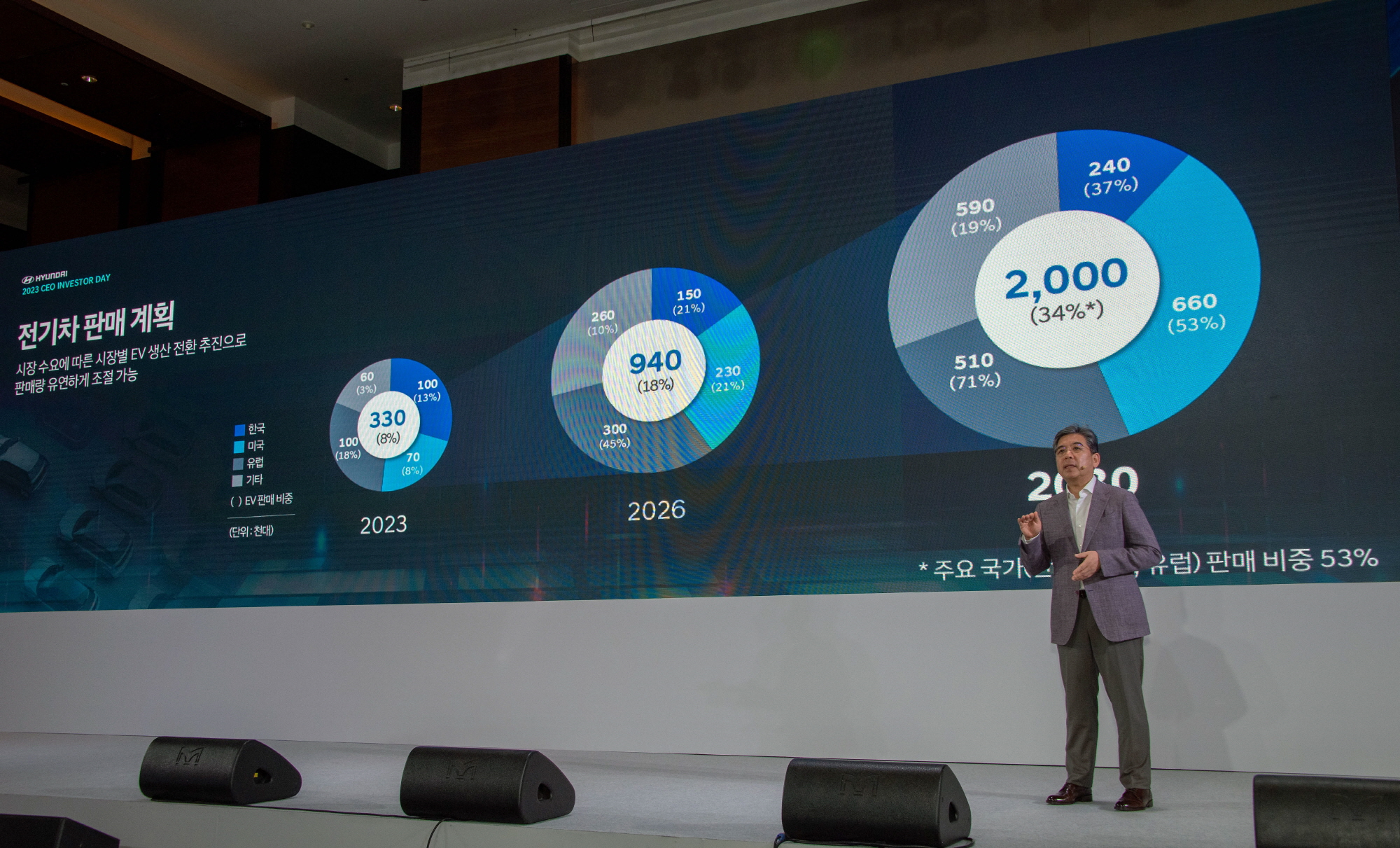

Hyundai has also set new global EV sales targets, including Genesis. Following its plan to sell 330,000 units this year, it has set goals for 940,000 units in 2026 and 2 million units by 2030. Hyundai plans to expand its global EV sales volume to three times its current level within three years and more than six times its current level within seven years. This adjustment marks an increase of 100,000 units and 130,000 units in the EV sales targets for 2026 and 2030, respectively, compared to last year’s CEO Investor Day announcement.

If achieved, the sales proportion of Hyundai and Genesis electric vehicles is expected to rise from 8% this year to 18% in 2026 and 34% in 2030. Notably, the proportion of electric vehicles sold in major regions (the US, Europe, South Korea) is anticipated to exceed half of total sales, with projections reaching 53% by 2030.

By 2030, Hyundai plans to sell 660,000 EVs in the US, accounting for 53% of total car sales. In Europe, it expects to sell 510,000 units, representing 71% of total sales, while in South Korea, 240,000 units are projected, equivalent to 37% of total sales. Hyundai aims to flexibly increase its EV sales in response to global market conditions.

To achieve these EV sales targets, Hyundai has named its core electrification strategy the ‘Hyundai Motor Way’. By transforming its clear strengths as a traditional automaker into future competitiveness and deploying differentiated strategies, Hyundai expresses its commitment to leading the most efficient and effective path in the era of electrification.

The ‘Hyundai Motor Way’ focuses on three detailed strategies: introducing an ‘integrated modular architecture’, enhancing EV production capabilities, and improving battery capabilities while driving the establishment of a value chain across the board.

Hyundai plans to not only stop at unveiling its dedicated electric vehicle platform ‘E-GMP’ at the end of 2020 but also aims to complete the ‘integrated modular architecture’ development system by 2025 and bring in a ‘2nd generation dedicated electric vehicle platform’ to once again lead the global finished car market.

The next-generation vehicle development system made possible by the integrated modular architecture is a step beyond the current platform-centric development system, maximizing cost reduction through economies of scale. While the current system allows parts sharing only among models using the same platform—with about 23 shared platform parts—the integrated modular architecture will facilitate the development of models through 86 shared module systems applicable across all vehicle classes without any class distinctions.

Currently, the Ioniq 5 based on the dedicated electric vehicle platform E-GMP and the Kona Electric derived from the internal combustion engine platform are incompatible under the present development system. However, with the introduction of the integrated modular architecture, key strategic modules including motors and batteries, as well as inverters and electric electronics, will be shared across the board.

The ‘2nd generation dedicated electric vehicle platform’, which will follow the E-GMP, is expected to play a central role in the integrated modular architecture development system. Compared to the current E-GMP focused on mid-sized SUVs, the platform range for shared development will expand to encompass almost all classes including small to super-sized SUVs, pickup trucks, and higher-end Genesis models. From 2025 to 2030, Hyundai plans to develop four Hyundai EV models and five Genesis models based on the 2nd generation dedicated EV platform. (Including four Kia models, a total of 13 models within the Hyundai Group)

The 2nd generation dedicated EV platform is planned to be developed with the goal of incorporating 5th generation NCM (Nickel-Cobalt-Manganese) batteries and high-efficiency, high-output motor systems, while also promoting the application of LFP (Lithium Iron Phosphate) batteries that offer advantages in form factor diversification, economic efficiency, and safety.

Hyundai is also preparing foundational technologies such as the use of the world’s first auxiliary battery for on-the-move charging and discharging technology to further extend driving range. The battery will incorporate an AI-based Battery Management System (BMS) with remote diagnostic capabilities and rapid heat diffusion shield technologies for fire safety.

Furthermore, the 2nd generation dedicated EV platform is being developed with significant consideration for compatibility with software architectures necessary for realizing SDV. Hyundai plans to develop an app ecosystem through the application of an open OS in the 2nd generation dedicated EV platform and aims to implement advanced autonomous driving features at level 3 and above, as well as remote parking and departure control functionalities.

Meanwhile, Hyundai intends to continue its electric vehicle lineup strategy using its existing ICE platforms alongside the introduction of the next-generation dedicated platforms. It plans to strategically maintain its electric vehicle lineup by continuously operating derivative EV models like the Kona Electric without additional developmental costs.

Hyundai is focusing on expanding its EV production capacities to effectively respond to the growing global electric vehicle demand. As a traditional automaker, it is pursuing a ‘two-track’ strategy, transitioning existing internal combustion engine plants to become capable of EV production while also constructing new dedicated EV plants.

Initially, Hyundai is prioritizing the conversion of existing internal combustion engine production lines to mixed production lines compatible with electric vehicles. This approach is favored over building new plants due to the time and cost advantages, representing a significant strength as a traditional automaker.

The Ulsan and Asan plants, where the Ioniq 5 and 6 were introduced to the production line, have established themselves as core production bases for Hyundai’s electric vehicles after investments ranging from 50 to 100 billion won and modifications to the production lines over the span of a month. The ability to flexibly adjust production volumes to suit market conditions through concurrent production of internal combustion engine vehicles and EVs is a significant advantage. Utilizing existing plants also holds meaning in terms of supply chain management and maintaining regional economic ecosystems.

Through this approach of applying electric vehicle lines to existing internal combustion engine plants, Hyundai is currently producing EVs not only in Korea but also in the US, Czech Republic, and India, while planning for additional local line transitions in consideration of future demand growth. Moreover, it is committed to facilitating a natural transition for electric vehicle production in additional global plants.

Hyundai is actively working on expanding dedicated electric vehicle factories in key markets where electric vehicle demand is expected to grow significantly. The first dedicated EV factory, located in Georgia, USA, is set to start mass production in the second half of 2024, followed by a dedicated EV factory in Ulsan, aiming for production to commence in 2025. Hyundai plans to implement innovative manufacturing technologies from the ‘Hyundai Motor Group Singapore Global Innovation Center (HMGICS)’ into these dedicated EV plants to maximize production efficiency.

Through a two-track strategy for expanding production capabilities, Hyundai aims to grow the global share of electric vehicle production from 8% this year to 18% by 2026 and 34% by 2030. The proportion of EV production in major regions (the US, Europe, South Korea) is targeted to reach as high as 48% of total production by 2030.

In terms of major regions, Hyundai plans to increase the share of EV production in the fast-converting US market from 0.7% this year to 37% by 2026 and 75% by 2030. In Europe, the EV production share will rise from 7% this year, to 30% by 2026, then to 54% by 2030. In South Korea, the production share for electric vehicles is projected to grow from 14% in 2023 and 24% in 2026, reaching 36% in 2030.

Hyundai has been enhancing its capabilities regarding batteries, a core component of electric vehicles, having accumulated state-of-the-art design and production experience throughout the years. It continues to strive for performance enhancements and price competitiveness in its battery offerings.

Currently, Hyundai has established a dedicated battery development organization at its Namyang Research Center, focusing on battery systems, cell design, reliability, performance development, and next-generation batteries. In the next ten years, it plans to invest 95 trillion won into enhancing battery performance, developing next-generation battery technologies, and setting up related infrastructure.

Hyundai’s efforts to secure battery capabilities are not confined to internal efforts. It has been actively expanding collaborations with external partners, including established companies, startups, and academia. To ensure a stable supply of batteries, it is pursuing joint ventures with key battery companies like SK On and LG Energy Solutions while driving joint development efforts aimed at achieving top-tier performance.

For next-generation battery development, joint research and equity investments are underway with startups. Collaboration efforts are being made with companies such as Solid Power in the U.S. for solid-state battery components and process technologies, and with Solid Energy Systems (SES) in the U.S. for lithium-metal battery development.

The ‘Hyundai Motor Group-Seoul National University Battery Joint Research Center’, announced in November 2021, plays a crucial role in long-term technology capability enhancement and talent acquisition. The center is working on collaborative research projects focusing on battery management systems, lithium-metal batteries, and solid-state battery development and production technologies. Next month, a dedicated research space equipped with high-spec experimental equipment will be inaugurated at Seoul National University’s Gwanak campus to facilitate active collaborative research.

Hyundai is also making efforts to ensure stable supply sources for battery materials. It is working on contracts for lithium supply to serve as key materials for cathodes from its joint venture battery plant in Indonesia while forging partnerships with material companies to ensure the stable supply of essential raw materials, including lithium and nickel for electrification. Ongoing discussions with domestic agencies and foreign governments aim to strengthen the battery materials sector.

In the long term, to protect the environment and ensure sustainable raw materials procurement, Hyundai plans to set up a system for recycling raw materials from recovered batteries. Through collaboration with its affiliates, Hyundai aims to securely collect batteries and reintegrate the extracted raw materials into battery manufacturing to realize a sustainable ‘battery life cycle’.

Hyundai envisions building a value chain encompassing all areas of batteries by establishing strategies for stable material procurement, enhancing battery design and management capabilities, and planning for next-generation battery development.

This year, Hyundai will unveil a new hybrid (HEV) vehicle equipped with a self-designed battery. Having previously announced a memorandum of understanding (MOU) for joint development of battery cells for hybrid vehicles with SK On in 2021, Hyundai has taken on core processes from material verification to specification confirmation, design, product evaluation, and performance enhancement in this collaboration.

In addition, Hyundai is pushing for the development of various battery cells to ensure price competitiveness and respond to demands. Joint development of LFP batteries, which include battery cells and specialized battery systems, is ongoing. By around 2025, the co-developed LFP battery will be applied to electric vehicles for the first time, with plans to gradually expand the number of models equipped with it, focusing on emerging markets.

Hyundai is focusing on securing battery management capabilities that optimize electric vehicle performance. This includes technologies for battery conditioning, such as heating and cooling, as well as advancements in battery management systems to promote high levels of driving range, longevity, and safety. The high-performance electric vehicle ‘Ioniq 5 N’, set to be unveiled next month, will encompass Hyundai’s top-level EV thermal management technology, including ‘high-performance EV N specialized thermal management control’ to deliver maximum driving performance even in extreme conditions.

Additionally, Hyundai plans to accelerate the development of next-generation batteries, including lithium-metal batteries and solid-state batteries, by constructing a next-generation battery research building at its Uiwang Research Center by next year. Hyundai is considering conducting production verifications through small-scale pilot lines to enhance the completeness of the next-generation battery development. In the future, next-generation batteries are expected to play a crucial role in enhancing synergies across future mobility businesses such as robotics and AAM.

The highly-anticipated high-performance electric vehicle ‘Ioniq 5 N’, set to debut in July, symbolizes the implementation of the Hyundai Motor Way.

Since the launch of its high-performance N brand in 2015 and the introduction of its first model in 2017, Hyundai has delighted customers with the driving pleasure derived from exceptional performance. With the upcoming launch of the Ioniq 5 N, Hyundai will transform into a high-performance electric vehicle brand, becoming the first automaker to possess both a dedicated electric vehicle brand, ‘Ioniq’, and a high-performance EV brand simultaneously.

Hyundai has achieved advancements in various hardware technologies such as suspension, body durability, and braking systems through its internal combustion engine N models, and has continuously improved software controlling technologies for BMS (Battery Management System), thermal management, and high-performance driving through models like the Ioniq 5. Hyundai plans to consolidate its top-tier technologies into the Ioniq 5 N, pioneering a new domain in high-performance electric vehicles and solidifying its leadership position in the electric vehicle market.

CEO Jang Jae-hoon stated, “I believe that advancing the technical capabilities passed down from the past to create human-centered innovations embodies the value that a company with heritage can bring. Just as the ‘Ioniq 5’, which heralded the start of electrification, was inspired by the historically significant ‘Pony’, the forthcoming ‘Ioniq 5 N’, as a high-performance electric vehicle, will play a significant role in inheriting Hyundai’s heritage while firmly establishing our EV leadership.”

Beyond the transition to electrification, Hyundai is actively working to become a ‘smart mobility solution provider’ to realize future mobility services.

First and foremost, Hyundai aims to secure new growth engines beyond carbon neutrality by unveiling its vision for a future hydrogen ecosystem. In particular, it plans to build a ‘hydrogen business toolbox’ in collaboration with various entities within the Hyundai Group to realize the hydrogen ecosystem vision.

The hydrogen business toolbox refers to a lifecycle model of hydrogen business that is organically connected from hydrogen production to the application of eco-friendly components such as green steel for achieving supply chain carbon neutrality, the implementation of eco-friendly logistics systems using hydrogen energy, and the sale of hydrogen fuel cell vehicles. Hyundai intends to apply this hydrogen business toolbox at HMGMA and will unveil concrete hydrogen business visions and strategies at the International Electronics Exhibition early next year.

Hyundai is concentrating on enhancing future vehicle technology. In autonomous driving, through its joint venture ‘Motional’, established with Aptiv in March 2020, it is advancing technology development and commercialization efforts. Motional plans to commercialize its unmanned robo-taxi service based on the Ioniq 5 at the end of 2023, subsequently expanding this service into major global regions.

The transition to software-based SDV development systems is being propelled forward by ’42dot’, acquired in August last year. The HMG Global Software Center, 42dot is making plans to create new growth engines through in-house software technology development and purpose-based mobility services utilizing a software technology platform called the ‘Titan Platform’.

The robotics business is among the most anticipated future endeavors whereby Hyundai aims to achieve synergy through two entities, Boston Dynamics and Robotics Lab, by continually expanding operations in different domains.

Since its acquisition in 2021, Boston Dynamics has been working on securing next-gen robotics technologies through products like the four-legged robot ‘Spot’ for inspections in industrial settings, intelligent logistics robot ‘Stretch’, and multi-purpose humanoid robot ‘Atlas’. Meanwhile, Robotics Lab is introducing new value-generating robot services with offerings like the wearable robot ‘X-ble MEX’ for medical rehabilitation, multi-purpose mobile platform ‘Mobed’, and customer service robot ‘DAL-e’.

In the field of aerial mobility, Hyundai is pursuing its AAM (Advanced Air Mobility) business through the establishment of Supernal in the U.S. in 2020. In both the short and medium term, it plans to develop full-scale tech models for pilot passenger flight tests while securing the necessary infrastructure for aircraft manufacturing. Additionally, it is preparing to lead the establishment of an AAM ecosystem while planning expansions into related businesses through collaborations with various partners.

Hyundai envisions actively addressing the risks facing its future business endeavors, transforming potential crises into opportunities.

In response to the challenges faced in China in recent years, Hyundai aims to improve profitability and enhance its image. Profitability will be advanced by optimizing factory production capacities and lineup efficiencies. After selling its first factory in China in 2021 and ceasing operations at its fifth factory in 2022, Hyundai plans to halt production at one additional factory this year. The two closed factories will be put up for sale, while the remaining two will focus on production efficiencies and expand exports to emerging markets by producing global models.

Furthermore, Hyundai will downsize its sales lineup in China from 13 models to eight, realigning its offerings to emphasize premium and SUV models like Genesis and Palisade. Especially, it plans to actively market its recently launched high-performance N brand, starting in Shanghai.

Hyundai will not only respond to its local operations in China but also tackle intensified market competition due to the global expansion of Chinese automakers. By strengthening differentiation in areas like brand, sales, and services, Hyundai aims to effectively navigate the risks involved in the global market entries of Chinese manufacturers.

In light of the global supply chain restructuring triggered by the U.S. IRA (Inflation Reduction Act), Hyundai plans to expand local EV production and localize component manufacturing as a response. To stabilize battery supply, it is working on expanding regional joint ventures (JV). The Indonesian battery joint venture is expected to start operations in 2024, along with two U.S. battery JVs that were announced to be established this year, projected to commence operations in 2025. The Hyundai Group anticipates that by 2025, these three joint ventures will supply more than 20% of its battery needs.

Hyundai is also considering establishing battery joint ventures in Europe and plans to explore new joint ventures and expand existing ones based on regions where electric vehicle demand is high. The Hyundai Group aims to ensure the stable procurement of over 70% of its battery needs through these joint ventures after 2028.

Hyundai announced its medium- to long-term financial strategy, which includes investing 109.4 trillion won from 2023 to 2032 to fund the execution of the Hyundai Motor Way alongside generating high profits from internal combustion engines and expanding future mobility ventures. It is targetting a 10% operating profit margin in the EV sector by 2030.

Hyundai has set a goal to achieve profitability of over 10% in the EV sector by establishing plans for the sale of 2 million electric vehicles by 2030, implementing the integrated modular architecture vehicle development system, operating strategically profitable derivative models, achieving cost reductions through production plant operational strategies, maintaining continuous cost reduction during production stages, and creating new revenue sources through SDV.

To support these profitability maximization efforts and to build a virtuous cycle of generating revenue for future business, Hyundai plans to invest an annual average of 11 trillion won from this year to 2032, amounting to a total of 109.4 trillion won. Specifically, this consists of 47.4 trillion won for R&D, 47.1 trillion won for capital expenditures (CAPEX), and 14.9 trillion won for strategic investments. Especially in 2024 and 2025, when investments are concentrated in electrification areas, the company plans to make investments of over 12 trillion won.

Through this CEO Investor Day, Hyundai emphasized the importance of reinforcing a virtuous cycle that supports stable revenue generation with continued investment and increased shareholder returns. Previously, the company announced measures to enhance shareholder value, including the introduction of quarterly dividends with a payout ratio set at over 25% and plans to buy back 1% of its shares over the next three years.

Hyundai plans to balance investments, revenue, and shareholder returns moving forward, adopting a strategic capital operation plan segmented into three phases for the medium and long term. In the first phase (2023-2025), investments in internal combustion engines and future technologies will be on equal footing. In the subsequent second phase (2026-2030), as EV sales increase and the next-generation EV platform is applied, investments in internal combustion engines will gradually decrease, while in the final third phase (after 2031), profits from EVs and software are expected to outpace those from internal combustion engines, essentially decreasing investments in internal combustion engines, thereby expanding investments in electrification and future mobility.

Lastly, the investment for electrification related to the execution of ‘Hyundai Motor Way’ is estimated at 35.8 trillion won over the next ten years, averaging about 3.6 trillion won annually. This represents an increase of 1.4 trillion won compared to the average of 2.2 trillion won announced at the last CEO Investor Day. The 95 trillion won earmarked for battery projects is included in the electrification-related investments.

Seo Gang-hyun, Vice President, stated, “Hyundai will continue to evolve into a sustainable and trustworthy company through our investment strategies focused on future technology, revenue generation, and shareholder returns.”

Jang Jae-hoon daedusj@autodiary.kr