The Korea Automotive Mobility Industry Association has released a report on the “U.S. Electric Vehicle Market Trends for the First Half of 2023.”

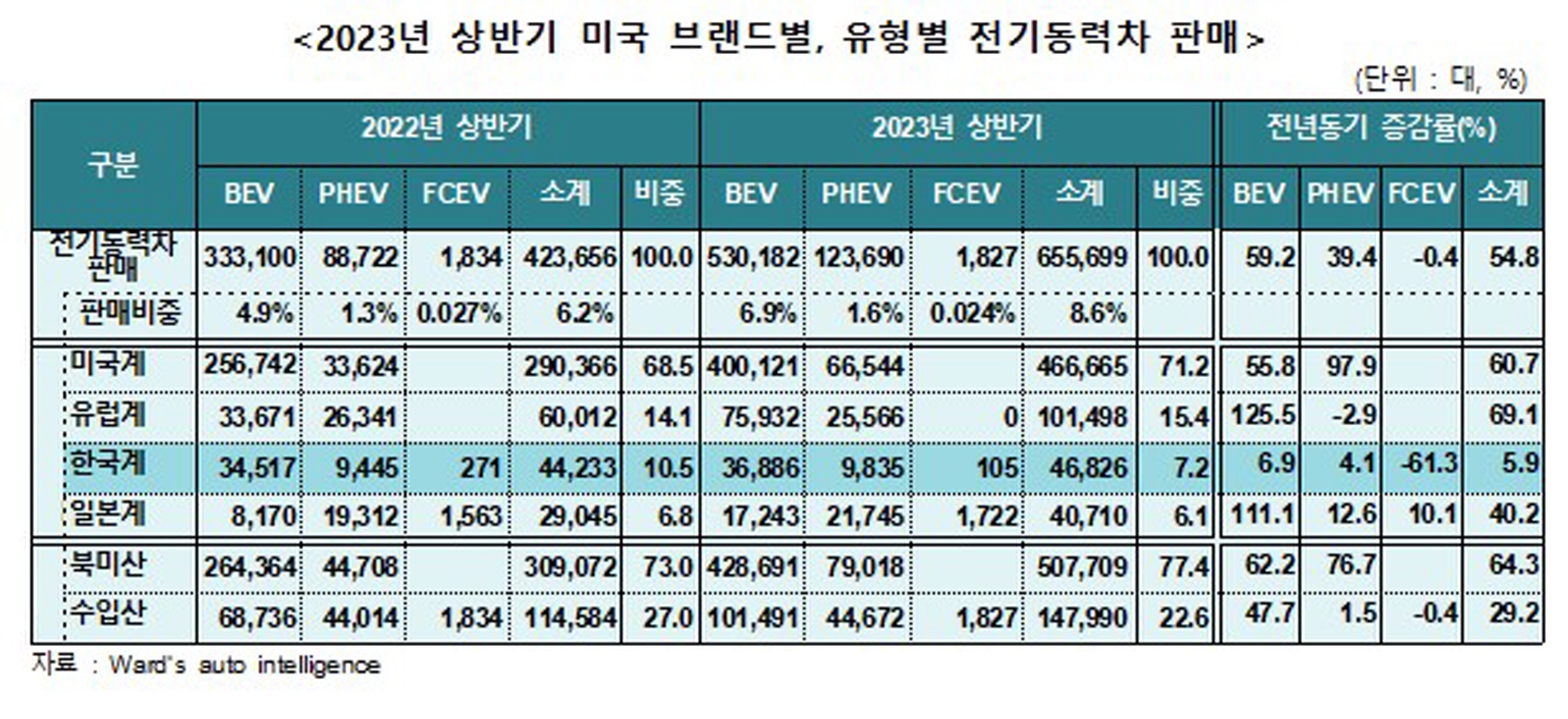

According to the report, the U.S. electric vehicle market increased by 54.8% compared to the previous year, driven by easing supply chain disruptions, intensified price competition, and the expansion of new models. The total sales share of electric vehicles reached 8.6% of all passenger cars (sedans + small trucks).

By type, BEVs saw a 59.2% increase, PHEVs increased by 39.4%, while FCEVs decreased by 0.4% due to model aging and reductions.

Sales of North American electric vehicles increased by 64.3% compared to the previous year, with the sales share growing from 73% to 77.4%. By manufacturer nationality, U.S.-based brands experienced a 60.7% increase from the previous year, expanding their share from 68.5% to 71.2%, thus leading the U.S. electric vehicle market.

European brands saw a significant 125.5% increase in BEV sales compared to last year, benefiting from an expanded new lineup, operational electric vehicle factories in the U.S., and stabilized supply chains, resulting in an overall electric vehicle sales increase of 69.1%.

Although Korean brands experienced slowed growth due to the cessation of personal purchase incentives, efforts to increase the share of commercial sales through leasing and rentals, as well as lineup enhancements and incentives at the corporate level, helped them achieve a 5.9% increase in sales to approximately 46,800 units (7.2% market share).

Japanese brands also expanded sales by 40.2% due to the launch of new BEV models by major companies.

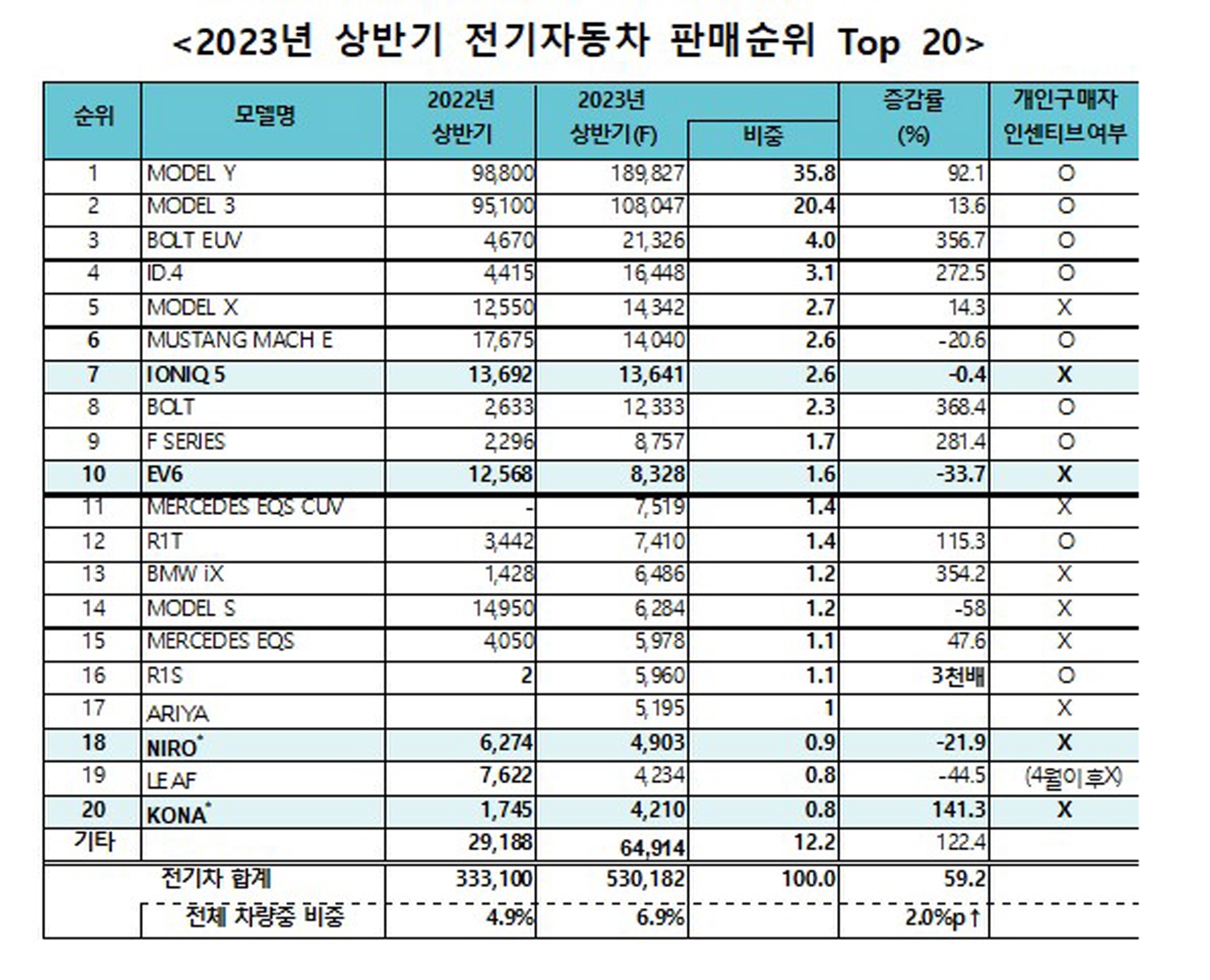

Looking at the sales rankings by model, Tesla’s Model Y and Model 3 topped the list of pure electric vehicles (BEVs), accounting for 56% of overall BEV sales. Despite being excluded from personal purchase incentives due to the IRA law, Korean brands had IONIQ 5 and EV6 rank 7th and 10th in the BEV Top 10, respectively.

Meanwhile, following the enactment of the IRA, major companies have accelerated their investment plans for the U.S. By the first quarter of 2023, automotive manufacturers and battery companies had invested approximately $115 billion in electric vehicle and battery-related investments, constructing 24 battery factories.

The production capacity for electric vehicle batteries in the U.S. is expected to increase from 55 GWh annually at the end of 2021 to a scale that can produce over 10 million pure electric vehicles (1,000 GWh) by 2030.

Kang Nam-hoon, president of the Korea Automotive Mobility Industry Association, emphasized that “as it becomes increasingly difficult for automakers to generate profits from electric vehicle sales amidst rising pressure for price reductions, competition among companies will become more intense.” He added, “To ensure the domestic automotive industry secures competitiveness in the global market, building a domestic electric vehicle ecosystem will be even more important, and institutional improvements should accompany securing labor flexibility to promote investments by foreign companies and enhance local production competitiveness.”

Jisang Lee daedusj@autodiary.kr