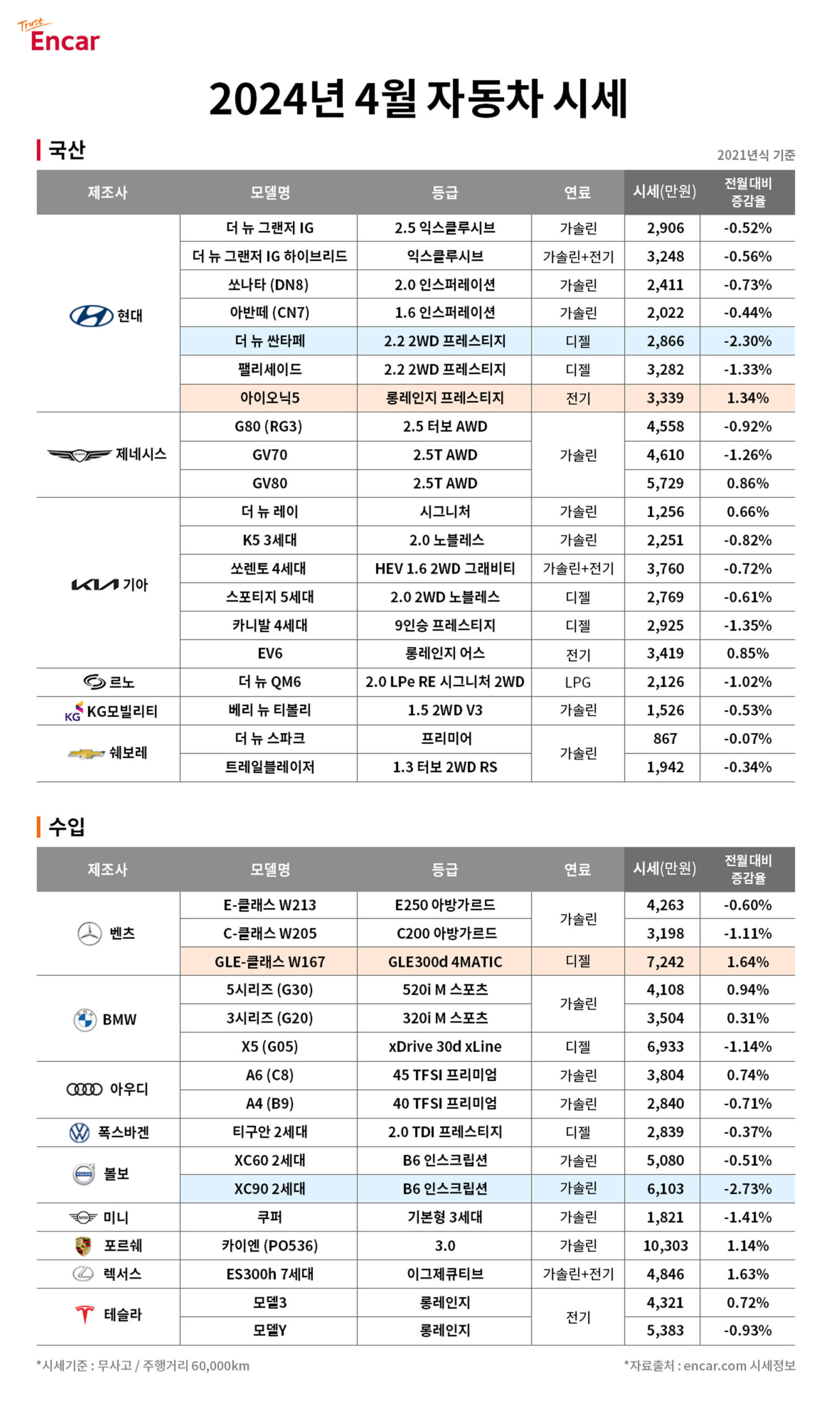

Encar.com has released the used car prices for April 2024. The data revealed is based on the analysis of popular 2021 models from domestic manufacturers like Hyundai, Kia, Renault Korea, KG Mobility, as well as imported brands such as Mercedes-Benz, BMW, and Audi. The analysis was conducted with a mileage benchmark of 60,000 km, focusing on accident-free vehicles.

April marks the entrance into the peak spring season, a time when used car transactions typically increase. The average prices for both domestic and imported cars in April showed a slight decrease of 0.34%, reflecting a moderate downward trend, which is less than the previous month’s decline. While some models have seen a rise in prices as transactions pick up, others maintained either a downward trend or showed minimal changes. Buying decisions should ideally be made before May if you’re considering a purchase.

Looking at the average prices for domestic vehicles, there’s been a decline of 0.49%, particularly among mid-size and larger SUV models, which exhibited a greater drop compared to the average. This month appears to be an ideal time for purchases before outdoor family activities increase in May. For instance, the Hyundai Palisade 2.2 2WD Prestige dropped by 1.33%, the New Santa Fe 2.2 2WD Prestige by 2.30%, and the Kia Carnival 4th generation 9-seater Prestige by 1.35%. Additionally, the Genesis GV70 2.5T AWD fell by 1.26%, and the Renault New QM6 2.0 LPe RE Signature 2WD dropped by 1.02% in price.

As is common at the start of a new semester or job hiring season, demand for compact cars increases. This month, the Chevrolet New Spark Premier showed no price change, while the Kia New Ray Signature saw a slight increase of 0.66%.

In contrast, the prices for domestic electric vehicle models rebounded this month. The Hyundai Ioniq 5 Long Range Prestige rose by 1.34%, and the Kia EV6 Long Range Earth also saw a slight increase of 0.85%. Some used electric vehicles are reported to be priced lower than new purchases after considering government and regional subsidies, which may reflect consumer demand.

The average price for imported cars decreased by 0.15%, indicating less fluctuation compared to domestic vehicles. Most imported models experienced changes of less than 1%, with relatively stable price movements; however, mid-size SUVs varied significantly by model.

The second-generation Volvo XC90 B6 Inscription faced a notable price drop of 2.73%, while the BMW X5 (G05) xDrive 30d xLine fell by 1.14%. Conversely, the Mercedes-Benz GLE-Class W167 GLE300d 4MATIC increased by 1.64%, showcasing the largest increase among imported cars, with the Porsche Cayenne (PO536) 3.0 also rising by 1.14%.

The hybrid model Lexus ES300h 7th generation Executive saw a 1.63% price increase. The Tesla Model 3 Long Range, which is no longer available for sale in the domestic market, experienced a slight increase of 0.72% this past month, reflecting ongoing demand.

Encar.com representatives noted, "There is a noticeable trend of active used car transactions correlating with reasonable consumer trends resulting from the economic situation and the traditional peak season for used cars. As we approach the end of April and into May, prices might further increase. Therefore, it’s advisable to consider domestic and imported mid and large SUVs with price drops or compact cars that show little to no price changes according to your budget and needs."

By Lee Sang-jin daedusj@autodiary.kr