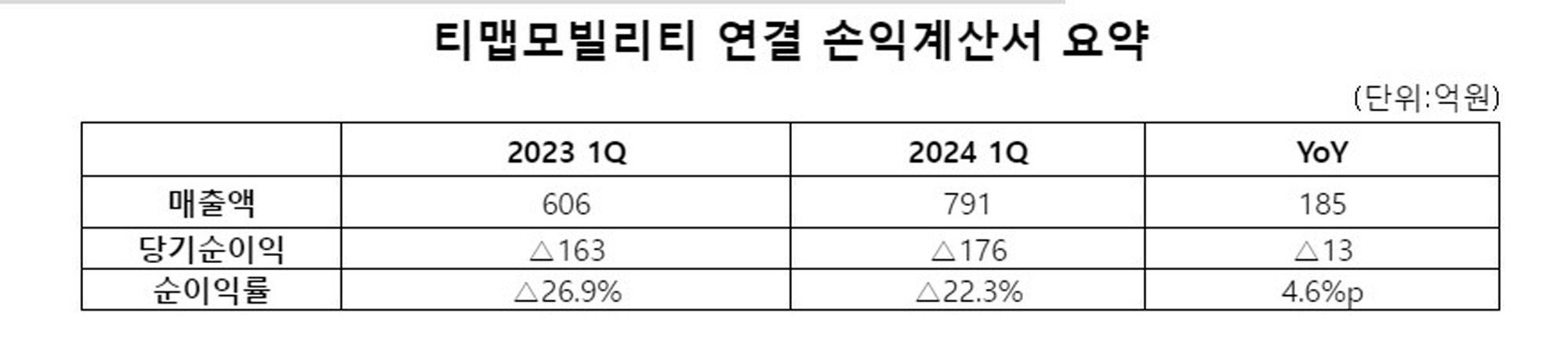

Tmap Mobility announced on the 16th that it recorded sales of 79.1 billion won in the first quarter. The steady growth of its Data & Tech division, including the infotainment solution TMAP Auto for complete vehicles and UBI (Usage-Based Insurance), has driven this performance.

The growth of TMAP Auto in the Data & Tech segment was particularly notable. TMAP Auto has established itself as a leading player in the SDV (Software-Defined Vehicle) market by collaborating with 18 domestic and international OEMs. This year, it achieved significant results in the in-vehicle infotainment (IVI) market by equipping some models of Mercedes-Benz and BMW with TMAP Auto.

In the first quarter, TMAP Auto’s sales increased by 114% compared to the previous year, and its order backlog approached 200 billion won, establishing a stable revenue base. Tmap Mobility explained, “Based on the experiences and know-how we’ve accumulated, we will continue to strengthen our competitiveness in high-precision mapping, which is essential for the upcoming era of autonomous driving, while also pioneering the SDV market.”

The growth of UBI is also noteworthy. The UBI sector recorded a 21% increase in sales compared to the previous year, fueled by a steady rise in active users and driving score adopters. The number of driving score users accounts for about 78% of the total subscribers on the TMAP platform, surpassing 63% of the registered vehicles in South Korea. Tmap Mobility is collaborating with nine domestic insurance companies, covering 98% of the country’s insurance market.

The mobility life and platform mediation sectors maintained a stable trend. The life sector recorded a 102% increase, driven by growth in advertising business. This was significantly influenced by rising unit prices due to increased traffic and the launch of new products. In the mediation area, the driver and cargo sectors began to stabilize, resulting in a 20% increase.

Quarterly net income was △17.6 billion won, a decrease of 1.3 billion won compared to the same period last year (△16.3 billion won). However, the improvement in net profit margin of 4.6% compared to the previous year indicates continued profitability improvement through fixed-cost efficiency.

Lee Jae-hwan, Chief Strategy Officer (CSO) of Tmap Mobility said, “While we have focused on expanding our reach by integrating various modes of transportation for user convenience, we will now leverage over 20 years of unique mobility data to evolve into a high-growth, high-value business model. We aim to transform ourselves into an AI-based mobility tech company based on our data competitiveness,” he stated.

Contact: 이상진 daedusj@autodiary.kr