The intention to purchase electric trucks is declining similarly to that of electric passenger vehicles, driven by concerns over driving range, charging, and prices. Expectations are that prices will drop by 6.72 million KRW compared to last year.

In an annual automotive research survey by Consumer Insight, which involved 23,017 truck owners, participants were asked if they were considering purchasing electric trucks, what their desired specifications were, and if they weren’t considering it, to explain why.

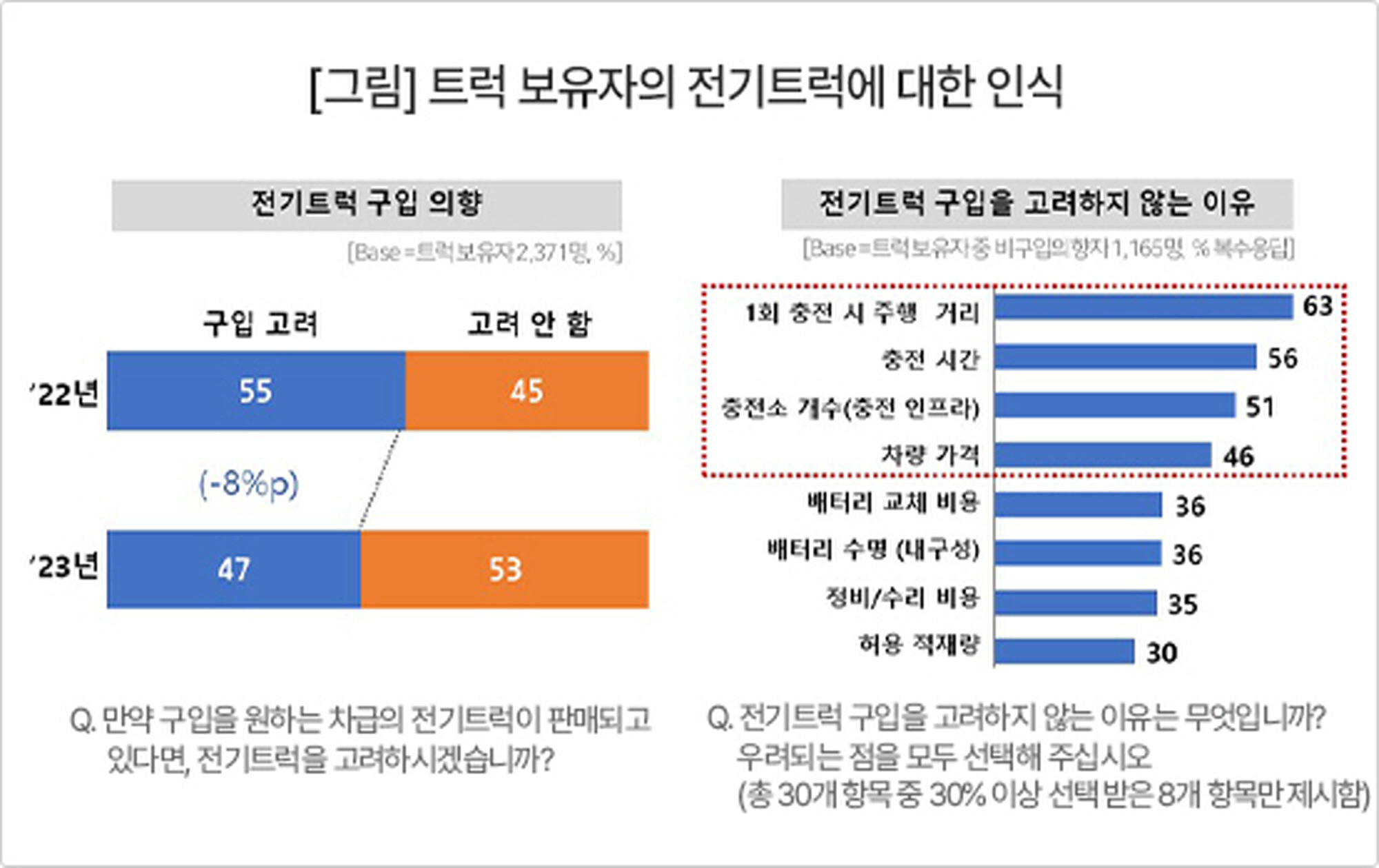

Among truck owners, 47% indicated that they would consider purchasing an electric truck if one in their preferred class were available. This marks an 8% drop from last year’s 55%. This trend aligns with the significant decrease witnessed in the electric passenger vehicle market, where intentions to buy surged for several years before plummeting last year (See: Declining purchase intentions for electric vehicles… Hybrid vehicles surge).

When asked why they were not considering purchasing electric trucks (multiple responses allowed), the primary concerns were: 1) Driving range on a single charge (63%); 2) Charging time (56%); 3) Number of charging stations (51%); 4) Vehicle price (46%). Battery-related concerns such as replacement costs and battery lifespan (each at 36%) also featured prominently. Overall, the results were consistent with last year’s findings.

Expectations regarding the specifications of electric trucks remain high. The anticipated driving range on a full charge is 522 km, slightly down from last year’s 540 km, but the average actual driving range falls short of this expectation, reported at just over 200 km—only 40% of what users anticipate. Given that these vehicles are often used for livelihood purposes, providing long-distance travel capability is crucial. There is an urgent need for improvements in actual driving range performance.

The additional amount that truck owners are willing to pay for an electric truck over a diesel truck is 12.24 million KRW, a decrease of nearly 2 million KRW from last year’s 14.18 million KRW. In contrast, the average expected total subsidy is 17.84 million KRW, which is 4.78 million KRW more than the government’s maximum subsidy of 13.06 million KRW this year. Considering both vehicle price and government subsidies, truck owners expect to pay 6.72 million KRW (1.94 million KRW + 4.78 million KRW) less than last year. This reflects a diminished view of the electric truck’s value compared to last year.

The decline in purchase intention for electric vehicles is observed in both passenger cars and trucks, with reasons for reluctance remaining consistent: driving range, charging issues, and vehicle pricing (See: What concerns are larger than charging time for electric vehicles? Decreased driving range in winter). However, unlike electric passenger vehicles, which are increasingly adopting dedicated platforms, with recent mainstream models surpassing 500 km in driving range and lower pricing partially meeting consumer expectations, the purchase intention continues to decline.

On the other hand, 1-ton small electric trucks are still being produced without a dedicated platform, simply retrofitting batteries to existing internal combustion engine platforms. This has resulted in complaints about short driving ranges and long charging times, with solutions still out of reach. Thus, the recovery of purchase intentions may lag further behind that of passenger vehicles and will likely follow only after issues related to passenger cars have been addressed.

Author: Lee Sang-jin daedusj@autodiary.kr