The continuous economic downturn has led to a higher preference for affordable used cars, and market prices are expected to remain solid.

K Car has announced that, based on an analysis of average market prices for over 740 models launched within the last 12 years in the South Korean used car market, prices for affordable used cars in the 10 million won range are expected to show strong performance in December. Conversely, prices for near-new and high-end used cars are projected to decline.

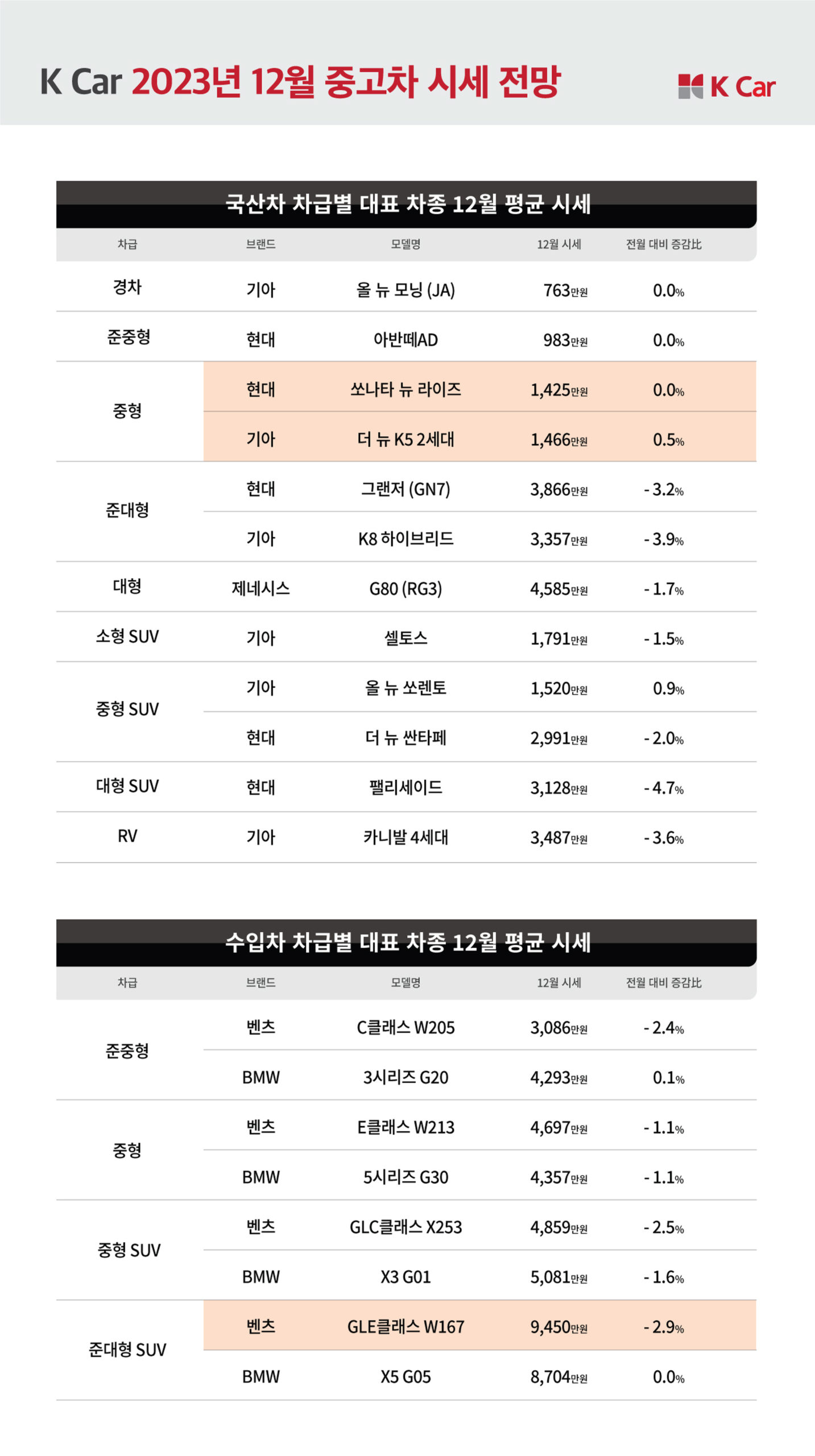

Key domestic used car models in the 10 million won range for December include ▲Kia All-New Sorento (up 0.9% compared to last month) ▲Kia The New K5 2nd Generation (0.5%) ▲Chevrolet Trailblazer (0.4%) ▲Hyundai Sonata New Rise (0%) ▲Kia Sportage 4th Generation (0%), which are recognized as vehicles offering good value.

Jo Eun-hyung, an analyst at K Car PM team, stated, “Models priced around 10 million won in the used car market have depreciated by more than half compared to the original price of new cars, making them highly rated for their value for money. With consumer sentiment under pressure due to the challenging economic situation, the preference for mid-range models is rising, which is expected to sustain market prices in December.”

In contrast, the prices for high-end near-new used cars are anticipated to decline due to the economic downturn and promotional activities from automotive manufacturers that have been ongoing since the third quarter.

The Genesis G80 (RG3) Electrified (-10.1%) and Genesis eGV70 (-7.0%) have experienced significant drops due to decreased demand and sluggish sales in the electric vehicle sector. Additionally, models like Hyundai Palisade (-4.7%), Kia K8 Hybrid (-3.9%), and Hyundai Grandeur GN7 (-3.2%) have seen price reductions linked to new car promotions, which are also affecting the used car market. Imports are similarly impacted, with steep discounts on new models leading to declines for models like the Mercedes-Benz GLE Class W167 (-2.9%), Mercedes-Benz GLC Class X253 (-2.5%), and Mercedes-Benz C Class W205 (-2.4%).

K Car leverages 23 years of experience in the used car industry to build a systematic and accurate price analysis and forecasting system, which is utilized in its purchasing and sales operations. As a leading company in the increasingly competitive used car market, it plans to share price information and lead the industry.

Meanwhile, K Car, which was listed on the KOSPI market in October 2021, has established itself as the largest direct used car platform company in South Korea with 23 years of experience. Operating under a direct sales system, it directly sells vehicles acquired through its own channels, backed by the largest nationwide direct network of 48 locations (as of December 2023), introducing the e-commerce service ‘My Car Purchase Home Service.’

Since its launch in 2016 as the first in the industry, the My Car Purchase Home Service has seen annual growth and now accounts for over half of total retail sales. This places K Car in an 81% market share in the domestic used car e-commerce sector, solidifying its status as a leader in the automotive e-commerce field.

Lee Sang-jin daedusj@autodiary.kr