Kia has launched various new car purchase programs, including ‘variable-rate financing’ and ‘custom financing.’

With these new programs, Kia aims to alleviate the burden of vehicle purchases for customers amid rising interest rates and to broaden choice, allowing customers to select financing products that fit their situations.

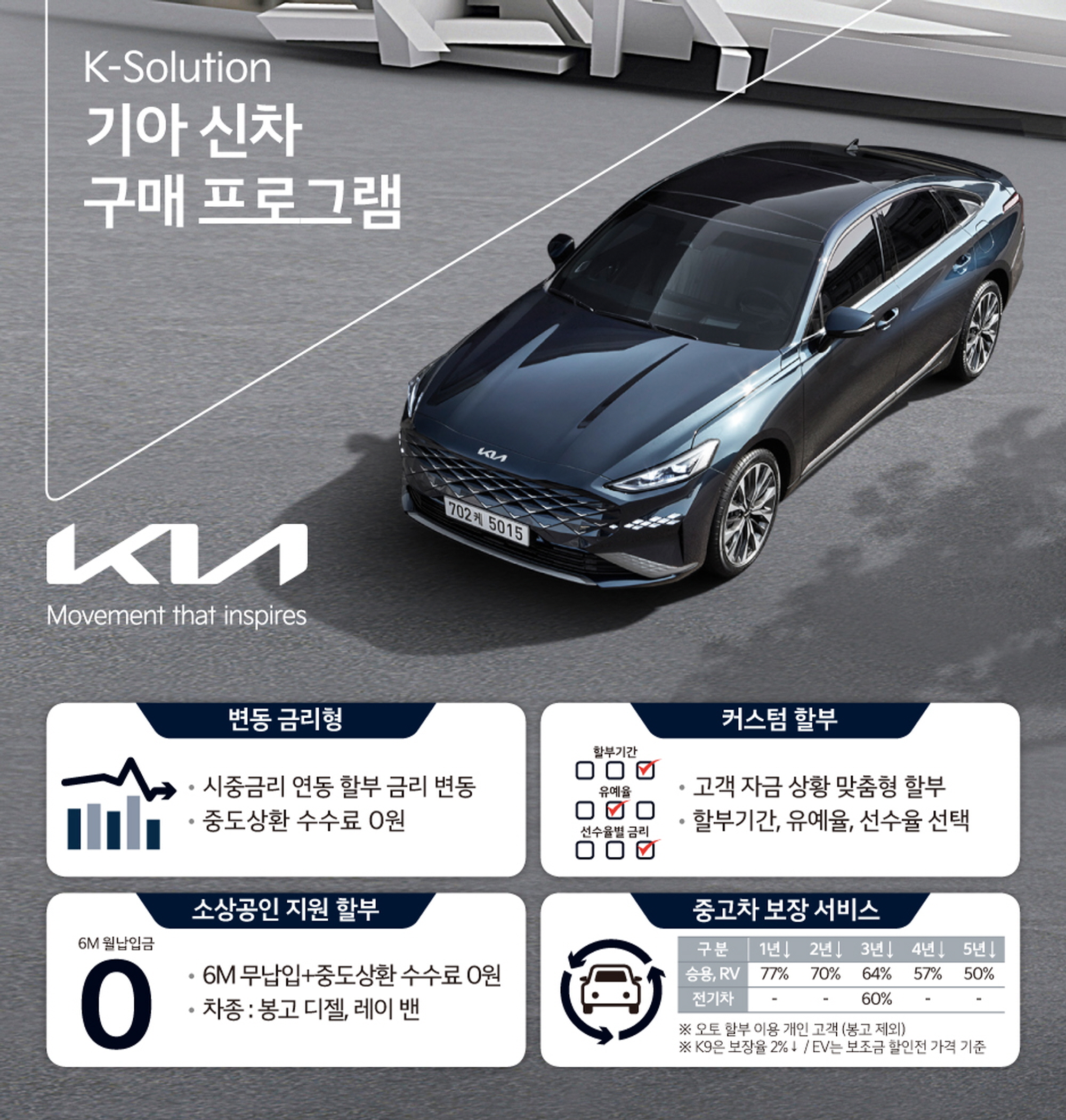

The ‘variable-rate financing’ is a single 60-month installment product where the financing rate is determined every three months based on the interest rate of 91-day certificates of deposit. In the case of a future rate decrease, customers’ interest burden could be reduced.

For example, when purchasing a Kia vehicle using Hyundai Card’s M-series card in February, a starting interest rate of 7.3% will be applied, and after three months, the financing rate will be adjusted to the average CD rate of the previous month, which will change quarterly.

This program is available to individual and sole proprietorship customers and can be applied to all Kia models. Additionally, in order to reduce the customers’ burden, there is no prepayment fee, allowing customers to repay at any time they need.

Kia also offers a ‘custom financing’ option, allowing customers to design their financing terms according to their financial situation, including factors like the financing period, deferral rates, and down payment rates.

‘Custom financing’ is aimed at individual and sole proprietorship customers, requiring a down payment rate of over 10% when using Hyundai Card’s M-series card.

Customers can choose from financing periods of 24, 36, or 48 months and set a deferral rate ranging from a minimum of 5% to a maximum of 55%. If the financing period is 48 months, the deferral rate can go up to 45%.

Down payment options include over 10%, 30%, and 50%, with preferential interest rates of 7.2%, 7.0%, and 6.8% applied respectively.

Further details about financing options such as ‘variable-rate financing’ and ‘custom financing’ can be found on the Kia website or at Kia dealerships nationwide.

A Kia representative stated, “We have prepared various purchasing programs to ease the burden on customers in an era of high interest rates” and added, “We will continue to introduce purchasing products that align with customer perspectives.”

Kia is also operating a ‘support financing’ program for small business owners who purchase vehicles like the Bongo diesel and Ray van, allowing them to use the vehicles for the first 6 months without monthly payments. Additionally, they are running a promotional financing program linked to the Bank of Korea’s base rate (3.5% as of February 1).

Furthermore, Kia is working to improve customer satisfaction by providing used car warranty services of up to 77% exclusively for individual customers using Kia Auto financing.

Jin Sang, daedusj@autodiary.kr