The previously soaring prices of new-class vehicles are expected to enter a downward trend due to strong demand changes.

K Car has analyzed the average prices in November for over 740 domestic and imported models launched within the last 12 years in the used car market in Korea, reporting an anticipated decline in prices across the board, particularly for new-class electric and hybrid vehicles.

Recently, new-class electric and hybrid used cars have tended to absorb the demand for new cars due to delays in new vehicle deliveries. Consequently, in some popular models, there has been a phenomenon of ‘price inversion,’ where their prices were sold 10% to 15% higher than their brand-new counterparts.

The reason for the decline in prices for these vehicles, which previously experienced price inversion and performed well in retaining value, is attributed to worsened consumer sentiment due to rising prices and high-interest rates.

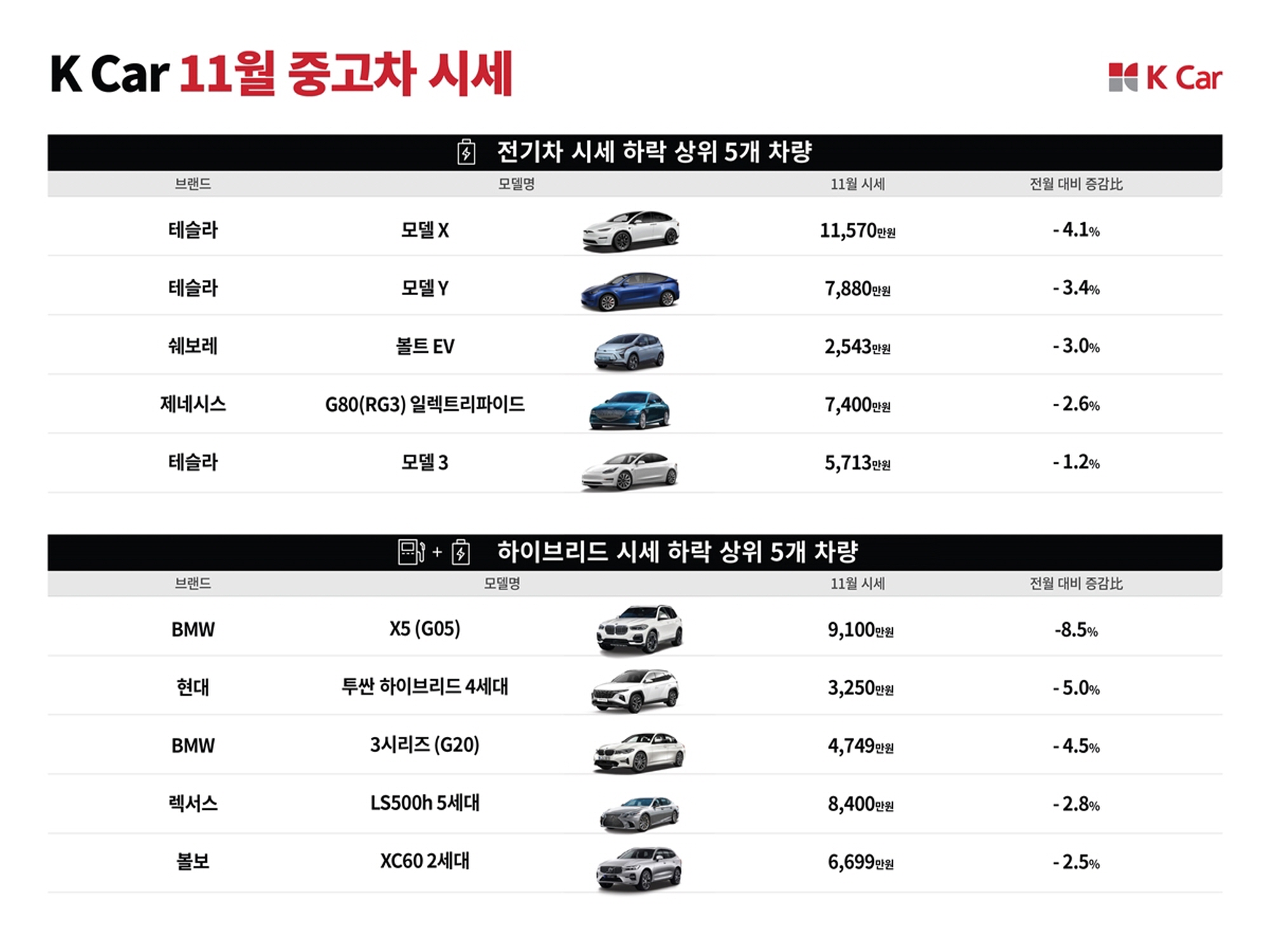

For the prominent electric vehicle brand ‘Tesla’, all three models, except for the price-stable ‘Model S’, are projected to see price drops. ‘Model X’ is expected to decrease by 4.1%, ‘Model Y’ by 3.4%, and ‘Model 3’ by 1.2%.

On the 24th of last month, Tesla reduced new car prices by up to 9% due to concerns over declining electric vehicle demand in the Chinese market. In Korea, the ‘Bolt EV’ is forecasted to drop by 3% while the ‘G80 Electrified’ is expected to decline by 2.6%. New-class electric vehicles such as ‘EV6’ and ‘Ioniq 5’ are expected to maintain their current prices.

The decline is more pronounced for hybrid vehicles. Excluding some models like ‘K8 Hybrid’ and ‘The New Grandeur Hybrid’, which are in a stable pricing trend, most hybrids are expected to decrease between 1% and 5%. Key popular models such as ‘Tucson Hybrid’, ‘Sonata DN8 Hybrid’, ‘Sorento Hybrid 4th Generation’, and ‘K5 Hybrid 3rd Generation’ are anticipated to drop by 5%, 1.8%, 1.3%, and 1%, respectively.

Even domestic and imported vehicles, which had previously shown good retention of value, are expected to face a general decline.

The decline rate for domestic models is projected to drop from 35% last month to 54%, a decrease of 19 percentage points, with models from Chevrolet and Hyundai expected to exceed 70% in falling price proportions. ‘Maxcruz’, ‘The New Veloster’, and ‘Equus (new model)’ are predicted to experience the highest declines, with drops of up to 6.4%.

Imported vehicles are expected to see even sharper declines. The drop rate is projected to increase from 39% last month to 62%, a rise of 23 percentage points, with the four major German manufacturers anticipated to have around 80% of their models declining. ‘The Passat’ is expected to show the largest drop at 7.9%, while ‘X1’ and ‘S60 Cross Country’ are anticipated to decrease by 6.9%.

Author: Lee Sang-jin daedusj@autodiary.kr