The Korea Automotive Mobility Industry Association has released a report titled “Current Status of China’s Automotive Industry Competitiveness.”

According to the report, the growth of local Chinese companies specializing in electrification and autonomous driving technology is expanding beyond the domestic market to overseas markets.

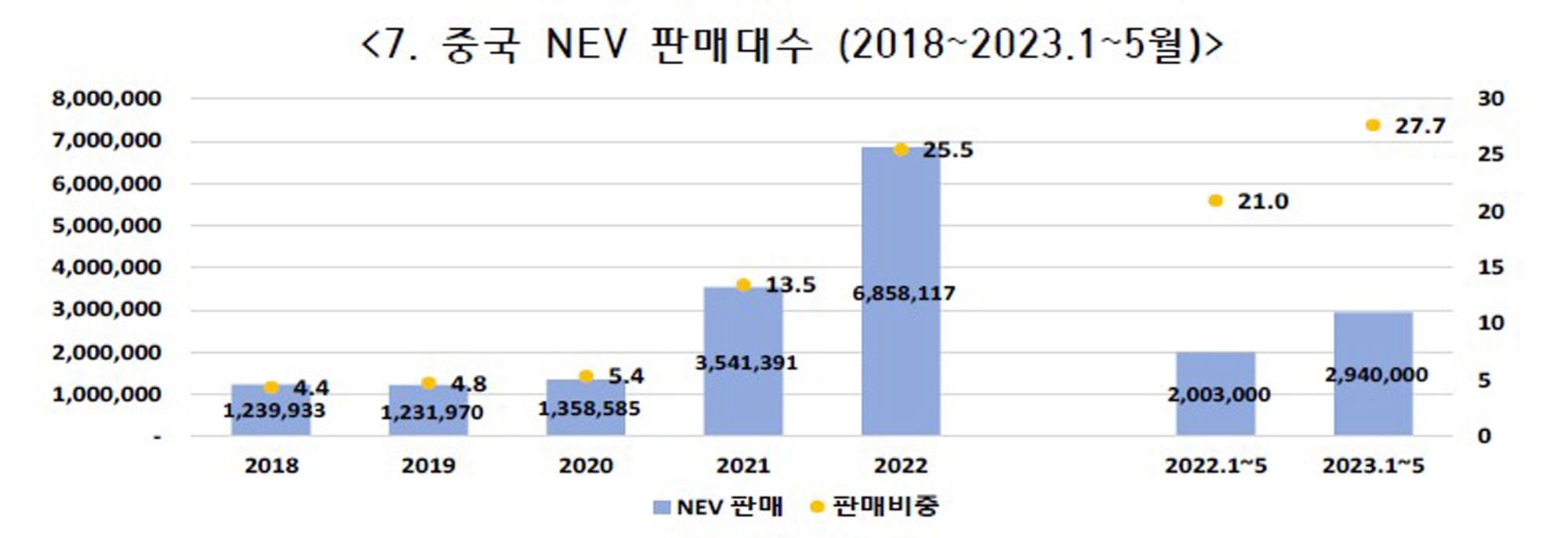

From January to May 2023, China’s production of NEVs (New Energy Vehicles) increased by 45.1% compared to the previous year, while sales rose by 46.8%, accounting for 28.1% of total automobile production and 27.7% of total sales.

Exports of NEVs from January to May 2023 increased by 162.6% compared to the previous year, making up 26.0% of total automobile exports, up from 18.0% in the same period last year.

Major NEV export destinations included Belgium, the United Kingdom, Thailand, Spain, Australia, the Philippines, Israel, and the Netherlands.

Looking at the sales status of electric vehicles by company, only two Chinese brands, BYD and Geely Group, ranked within the top ten from January to May 2022. However, with the explosive growth of the Chinese NEV market and expanded exports and international market presence, four companies, including BYD, Geely Group, SAIC Group, and GAG Group, have now entered the top ten.

With the sunset of NEV subsidies in 2023, competitors are exiting the market due to diminishing competitiveness. Companies that have competed fiercely in the domestic market are also strengthening their electrification strategies and expanding overseas.

The Chinese government aims to use the development of the smart connected vehicle industry as a breakthrough for establishing smart transportation, driving industrial growth through the construction of smart transportation systems. They emphasize the formulation of standards and R&D policies for autonomous driving, marking a paradigm shift from ‘competition in electrification’ to ‘competition in smart technologies.’

Given the high consumer acceptance and willingness to pay for autonomous driving technology, coupled with proactive governmental support, the autonomous vehicle market in China is undergoing rapid growth. The level of Chinese autonomous driving is transitioning from Level 2 (L2) to Level 3 (L3).

According to a report by 36kr’s China Autonomous Driving Industry (2023), the proportion of Level 2-equipped vehicles among new cars in China was 35% in 2022 and is expected to rise to 51% in 2023, while Level 3 will increase from 9% to 20%.

Chinese local automakers are not only developing their autonomous driving technologies independently but are also forming extensive partnerships with ICT, semiconductor, and LiDAR companies to improve the efficiency of driving data collection and reduce development costs, securing price competitiveness for autonomous driving systems.

Kang Nam-hoon, president of the Korea Automotive Mobility Industry Association, stated, “China’s automotive industry has secured global competitiveness through a comprehensive and systematic industrial promotion strategy that connects materials, batteries, complete vehicles, and autonomous driving. In the future, competition with our companies in the overseas market is expected to become even fiercer.” He emphasized the urgent need for prompt legislation on special laws to create a future automotive ecosystem and ensure flexible labor structures to secure a stable supply chain for batteries, establish domestic future vehicle production bases, and train skilled personnel.

By Lee Sang-jin daedusj@autodiary.kr